Imagine this: You open your mortgage statement, and instead of confusion, you feel calm. Everything is clear – your balance, your next payment, even your escrow details. No more hunting for answers or waiting on hold. That’s the reality SLS Mortgage aims to deliver every single day. In the often complex world of home loans, having a servicer you can trust isn’t just nice; it’s essential for your financial peace of mind. And that’s precisely where SLS Mortgage shines.

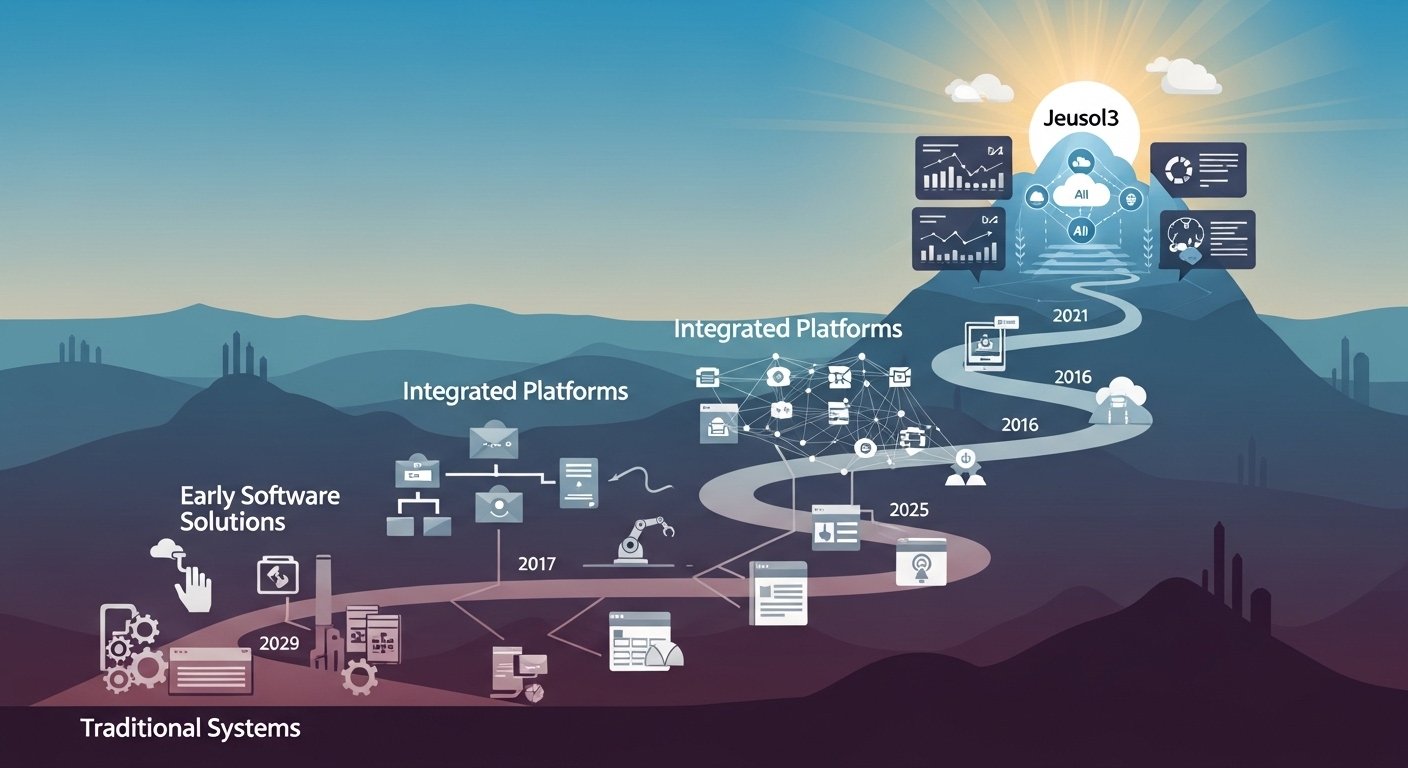

Specialized Loan Servicing (SLS) isn’t just another name in the mortgage industry. With a massive portfolio exceeding $112 billion in residential loans and a leadership team boasting an average of over 23 years of mortgage expertise, SLS brings unparalleled depth and stability to managing your most significant investment – your home. They’ve spent nearly two decades mastering the intricacies of Residential Mortgage-Backed Securities (RMBS) servicing, building a foundation of robust risk management and borrower-focused solutions. Plus, a major evolution in May 2024 saw the SLS servicing business fully integrate into a leading nationwide lending platform, unlocking even greater technological power and seamless service continuity for homeowners just like you.

Why Your Mortgage Servicer Matters More Than You Think

Think of your mortgage servicer as the conductor of your home loan orchestra. They don’t originate the loan, but once you close, they handle everything:

- Processing your monthly payments

- Managing your escrow account (for taxes and insurance)

- Handling customer service inquiries

- Administering modifications or forbearance plans

- Overseeing the loan if issues arise

A good servicer makes this process smooth and transparent. A poor one can turn it into a stressful, confusing nightmare. Choosing (or understanding) who services your loan – like SLS Mortgage – is crucial for a positive homeownership experience.

SLS Mortgage: Built on Experience, Focused on You

What sets SLS apart? It’s the powerful combination of deep expertise and a genuine commitment to customer service.

- Decades of Proven Experience: With 19+ years specializing in RMBS servicing and leadership averaging over 23 years in the trenches, the SLS team has navigated every market fluctuation and regulatory change imaginable. This isn’t theoretical knowledge; it’s hard-won, practical experience applied to managing your loan effectively and securely.

- Robust Risk Management: Managing billions in loans requires ironclad processes. SLS employs sophisticated risk management practices, ensuring your loan is handled accurately, compliantly, and with the necessary safeguards. This protects both you and the investors behind your loan.

- The Power of Integration (May 2024 Update): The full integration of SLS into a top-tier nationwide lending platform wasn’t just a name change. It was a significant upgrade. This move means:

- Seamless Continuity: Your existing loan terms and servicing experience remain consistent and reliable.

- Enhanced Technology: Access to cutting-edge systems developed for a large-scale lender, directly benefiting SLS borrowers.

- Greater Resources: Backing from a major player in the mortgage space, ensuring long-term stability and service capacity.

Your Digital Command Center: The SLS Mortgage Online Portal

Gone are the days of waiting for paper statements or lengthy phone calls for simple questions. SLS Mortgage puts powerful tools directly in your hands through their secure, user-friendly online portal and mobile-friendly access. Think of it as your 24/7 mortgage dashboard:

- Real-Time Account Snapshot: Log in anytime to see your current balance, interest paid year-to-date, and loan payoff amount.

- Payment Schedule Clarity: View upcoming payment dates and amounts clearly, helping you budget effectively.

- Escrow Transparency: Easily access details about your property tax and homeowner’s insurance payments held in escrow. See projected balances and disbursements.

- Effortless Digital Payments: Set up automatic payments for ultimate convenience or make one-time payments securely online. No more writing checks or finding stamps!

- Document Access: Retrieve important statements, tax documents (like Form 1098), and loan correspondence instantly.

This portal isn’t just a tech add-on; it’s core to SLS Mortgage’s customer-centric philosophy. It empowers you with information and control, reducing stress and saving you valuable time. Example: Sarah J., an SLS borrower in Florida, shared how the portal helped her quickly verify her escrow payment for homeowner’s insurance renewal, avoiding a potential lapse. “It took me 2 minutes instead of what could have been a 30-minute phone call,” she said.

Who Benefits Most from SLS Mortgage Servicing?

While SLS manages loans for a wide range of borrowers, their specialized expertise offers distinct advantages for specific situations:

- Borrowers with Loans in RMBS Pools: This is SLS’s core strength. Their deep understanding of the unique requirements and reporting involved in these complex securities translates to precise and compliant servicing for these loans.

- Homeowners Seeking Stability: With decades of experience and now the backing of a major national platform, SLS provides a sense of reliability in an industry sometimes marked by turnover and consolidation.

- Tech-Savvy Borrowers: Those who prefer managing finances online will appreciate the robust, intuitive features of the SLS portal for payments and information access.

- Borrowers Needing Clear Communication: SLS’s focus on transparency means you’re less likely to encounter confusing statements or hidden processes. Their resources are designed for clarity.

Navigating Common Mortgage Servicing Questions with SLS

Even with a great servicer like SLS Mortgage, questions pop up. Here’s how they typically handle frequent scenarios:

- “I’m struggling to make my payment. What are my options?” SLS, like all regulated servicers, has loss mitigation departments trained to help borrowers facing hardship. Contact them early to discuss potential solutions like forbearance plans or loan modifications. Their experience helps navigate these complex processes.

- “How do I set up AutoPay?” This is usually straightforward via the online portal. Look for the “Payments” or “AutoPay Setup” section. You’ll need your bank routing and account numbers.

- “Why did my monthly payment change?” Most often, this is due to adjustments in your escrow account (if you have one). Your annual escrow analysis might show a shortage or surplus, leading to a revised payment. SLS’s portal provides detailed escrow breakdowns to explain changes.

- “What happened after the May 2024 integration? Is my loan different?” The core terms of your loan (interest rate, balance, maturity date) do not change with a servicing transfer or integration. The primary change for SLS borrowers is behind-the-scenes, leveraging better technology and resources from the parent platform to enhance service delivery. You might notice website or contact info updates, but your loan commitment remains intact.

Putting SLS Mortgage to Work for You: Actionable Steps

Understanding your servicer is step one. Here’s how to actively manage your relationship with SLS Mortgage:

- Register for Online Access Immediately: If you have an SLS-serviced loan, find your welcome letter or visit their official website (double-check the URL for security!). Registering for the online portal is the single best way to take control.

- Explore the Portal Features: Don’t just log in to pay. Check out the escrow details, view your payment history, and see what documents are available. Knowledge is power.

- Set Up AutoPay: Eliminate the risk of late payments and simplify your monthly routine. It’s usually the most secure and convenient option.

- Keep Your Contact Info Updated: Ensure SLS has your current email, phone number, and mailing address. This is critical for timely communication about your loan.

- Communicate Proactively if Issues Arise: If you foresee payment trouble or have a question, contact SLS early. Their customer service team is equipped to help, and early communication opens up more potential solutions.

- Review Statements Carefully: Take a few minutes each month to review your mortgage statement. Verify payments are applied correctly and check escrow balances.

Ready to experience mortgage servicing designed with clarity and expertise in mind? If SLS Mortgage manages your loan, you have a partner built on decades of experience and powered by modern tools. Leverage their online portal, stay informed, and don’t hesitate to reach out. Your journey to a smoother, less stressful mortgage experience starts today.

What’s one step you’ll take this week to better understand or manage your mortgage? Share your goal below!

You May Also Read: The White Oak Impact Fund: Your Guide to Investing with Purpose (and Profit!)

FAQs

Q: Is SLS Mortgage a lender or just a servicer?

A: SLS Mortgage (Specialized Loan Servicing) is primarily a loan servicer. This means they manage the ongoing administration of your mortgage loan (collecting payments, handling escrow, customer service) after the loan has been originated and funded by a lender or investor.

Q: How do I know if SLS Mortgage services my loan?

A: You will receive a welcome letter or notification in the mail and/or email when your loan is transferred to SLS for servicing. You can also check your most recent mortgage statement – the servicer’s name and contact information will be listed prominently. Look for “Specialized Loan Servicing” or “SLS.”

Q: What changed after the May 2024 integration? Will my loan terms be affected?

A: The core terms of your loan (interest rate, balance, monthly principal & interest, maturity date) DO NOT CHANGE due to the integration. The integration primarily enhanced SLS’s technological capabilities and operational resources by merging into a larger nationwide lending platform. You benefit from improved systems and stability, while your loan agreement remains the same.

Q: How do I make a payment to SLS Mortgage?

A: The easiest and most recommended way is through their secure online portal (via their official website), allowing for one-time or automatic payments (AutoPay). You can also typically make payments by phone or by mailing a check to the payment address provided on your statement and website. Always use official channels to avoid scams.

Q: What should I do if I’m having trouble making my SLS mortgage payment?

A: Contact SLS Mortgage Customer Service as soon as possible. Delaying communication limits your options. Explain your situation. SLS has loss mitigation specialists trained to discuss potential solutions like repayment plans, forbearance agreements, or loan modifications based on your circumstances and investor guidelines. Don’t wait until you miss a payment.

Q: How do I access my tax documents (like Form 1098) from SLS?

A: Your annual mortgage interest statement (Form 1098) is typically mailed by January 31st each year. You can also almost always access and download current and past year’s Form 1098 directly through your SLS Mortgage online portal account, usually in the “Statements” or “Tax Documents” section.

Q: Can I view my escrow account details online with SLS?

A: Absolutely! One of the key benefits of the SLS Mortgage online portal is transparent access to your escrow account. You can see your current balance, recent transactions (tax and insurance payments made), projected future balances, and details of your annual escrow analysis explaining any payment adjustments.