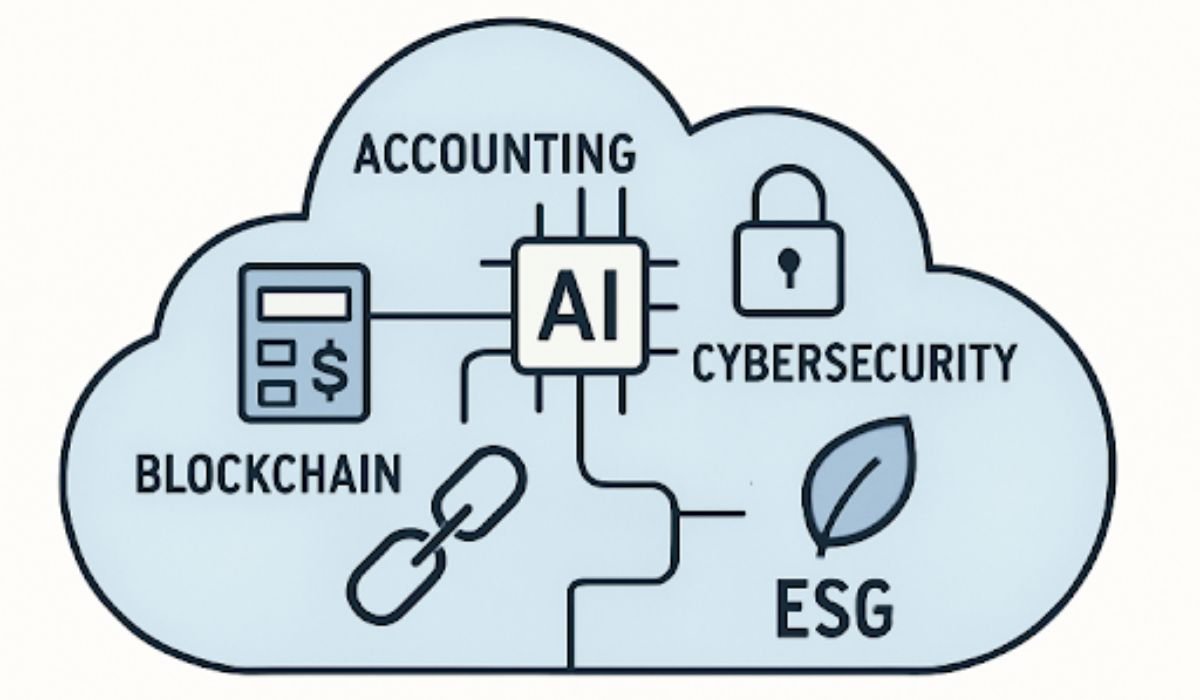

The accounting landscape is changing rapidly as cloud technology, automation, and advanced analytics transform how organizations manage their finances. Businesses large and small are moving away from legacy on-premise systems in favor of modern cloud-based accounting solutions that offer a competitive edge through flexibility, scalability, and seamless connectivity. Companies are increasingly turning to specialized experts, including those in growing markets like bookkeeper in Arlington, to stay ahead of technological advancements and regulatory changes.

As the accounting profession adapts, the integration of real-time financial data, mobile accessibility, and smart automation is enhancing efficiency and accuracy. These technological shifts are empowering accountants to focus on value-added activities, such as advisory services and strategic planning. With greater focus on data security and ESG compliance, cloud accounting is not only making practices efficient but also more sustainable and trusted.

The adoption of innovative solutions is coinciding with the ongoing evolution of regulatory frameworks and stakeholder demands. For example, external scrutiny on financial statements is higher than ever before, requiring a robust infrastructure that is both transparent and secure. The latest advances in machine learning, blockchain, and integrated systems position the cloud as the foundation of accounting’s next era.

Accountants today are also responding to new cultural and economic priorities—enabling remote work, fostering collaboration, and supporting the broader shift to digital business environments. As organizations navigate these trends, the right technology stack is not just a convenience but a necessity for sustainable growth and compliance.

For additional expert analysis on the impact of technology in finance, Forbes’s accounting and financial technology section frequently covers these themes with industry-specific insights and case studies.

The Rise of Cloud-Based Accounting

Cloud-based accounting platforms give organizations real-time financial insights and the ability to collaborate across physical locations. According to a Cloud2Me survey, 25% of accountants cited remote work enablement as their main reason for migrating to the cloud, while 20% prioritized enhanced security features. These platforms are designed to increase agility, with secure remote access and instant updates keeping teams connected and informed.

Businesses benefit from reduced overhead costs, more straightforward compliance, and on-demand scalability. Moving to the cloud also streamlines software updates and backup management, freeing up internal resources for more strategic pursuits. Accounting firms that leverage these solutions report higher client satisfaction and improved team retention, thanks to more flexible work arrangements. This ongoing trend aligns with global movements toward hybrid and remote work models.

Integration of AI and ML in Accounting

Artificial intelligence and machine learning are rapidly transforming accounting workflows by automating time-consuming tasks such as data entry, invoice categorization, and bank reconciliation. In early 2025, Xero’s AI-driven “Just Ask Xero (JAX)” tool marked a significant step, reducing repetitive work and providing predictive insights for payment management and account balancing. Industry reports highlight that these tools have cut manual input time by up to 38% for users, enabling firms to focus on advisory roles and higher-level analysis.

AI-powered analytics help identify trends, flag anomalies, and improve forecasting accuracy. As AI becomes more deeply embedded in accounting platforms, professionals can offer forward-thinking advice to clients and anticipate changes with data-driven confidence. These capabilities are leveling the playing field for small- and medium-sized firms, allowing them to compete effectively with larger organizations.

READ ALSO: Thrive Now: Your coyyn.com Digital Economy Roadmap

Enhanced Cybersecurity Measures

With the proliferation of cloud solutions, cybersecurity has become an urgent priority. Accounting firms are increasingly adopting zero-trust frameworks, multi-factor authentication, and endpoint detection systems. High-profile organizations like PwC now enforce encryption by default for all sensitive records, reflecting the industry’s proactive stance on safeguarding client data.

Protection against ransomware, phishing, and data breaches is critical as cyber threats evolve. Regular audits, ongoing employee training, and automated security incident responses are now standard practice. This foundational commitment to cybersecurity builds lasting trust with clients and regulators alike, as compliance standards become progressively stricter in response to global cyber risk trends.

Blockchain’s Role in Accounting

Blockchain is quickly becoming a mainstay for transparent, tamper-proof financial records. Its distributed ledger model allows accountants and auditors to independently verify every transaction in real time, reducing manual reconciliation and minimizing fraud. Innovations like triple-entry accounting and smart contracts are simplifying compliance and automating procedural steps, benefiting both internal teams and external stakeholders.

Notable use cases include PwC’s blockchain-powered networked audit system, which provides real-time transaction verification and traceability. As regulatory frameworks adapt to accommodate blockchain, more firms will likely explore these applications for both traditional accounting and emerging digital asset markets.

The Growing Importance of ESG Reporting

Environmental, Social, and Governance (ESG) metrics are now central to financial reporting. Stakeholders require transparent reporting on sustainability practices, labor standards, and corporate governance. Accountants are at the forefront of gathering, validating, and disclosing ESG data, which is becoming mandatory in many jurisdictions.

ESG reporting requires collaboration across multiple departments, and the accuracy of this information is often as critical as traditional financial data. Cloud platforms are facilitating ESG data collection, tracking, and reporting in standardized formats suitable for regulatory reviews and investor updates. As expectations around corporate responsibility and climate impact mature, accountants’ roles are set to expand significantly in this area.

The Shift Towards Mobile Accounting

Accounting on mobile devices is now a necessity due to evolving workforce preferences and client demands for immediate access to financial information. Increasingly sophisticated mobile apps enable the full spectrum of accounting processes—expense approvals, invoicing, and financial reporting—directly from smartphones and tablets.

This shift improves operational efficiency and collaboration, liberating accounting teams from office-based restrictions and enabling flexibility for both firms and their clients. Real-time notifications and the ability to manage tasks remotely ensure that decision-makers remain agile, even when out of the office.

Seamless Integration with Other Business Tools

Modern cloud accounting platforms emphasize integration with CRM, ERP, HR, and other systems. These interconnected tools facilitate the flow of financial data throughout an organization, eliminating silos and reducing redundancies. Automated data synchronization supports more accurate reporting and strategic decision-making.

As businesses expand and diversify, seamless integration allows organizations to scale operations efficiently and ensures all departments operate from a single source of financial truth. These benefits are especially valuable for fast-growing startups and multi-entity enterprises that require robust reporting and workflow automation.

Future Outlook

The accounting profession is on the verge of profound transformation. By embracing cloud-based solutions and leveraging the strengths of AI, blockchain, and integrated platforms, firms can remain competitive in a digital-first world. The ongoing prioritization of cybersecurity and the expanding scope of ESG reporting will continue to redefine what it means to deliver accounting services.

As technology and regulation evolve, firms that upskill and adopt best-in-class digital tools will set the new industry standard in 2026 and beyond.

YOU8 MAY ALSO LIKE: HQPotner: The Secret Weapon Modern Businesses Didn’t Know They Needed